H-D™ Visa® cards

A card for every need, a style for every rider.

-

5X

Earn 5X points at H‑D, gas and EV charging stations1

-

2X

Earn 2X points at restaurants, fast food, and bars1

-

2X

Earn 2X points at hotels & other lodging1

-

1X

Earn 1X points everywhere else Visa is accepted

H-D™ H.O.G.™ Elite Visa Signature® Card

The card that fuels your passion.

Get $100 at H‑D2

Just spend $500 on your H‑D Visa card in the first 90 days. Plus, get a 0% intro APR† on purchases and balance transfers* for 9 billing cycles. After that, a variable APR applies, currently 18.24% to 31.24%, view Hog Elite Visa terms.

- Get up to $99 in annual statement credits, including $59 for your H.O.G. Membership and a $30 dealer credit3

- 2X entries into the Free Ride Sweepstakes4 See Official Rules (PDF).

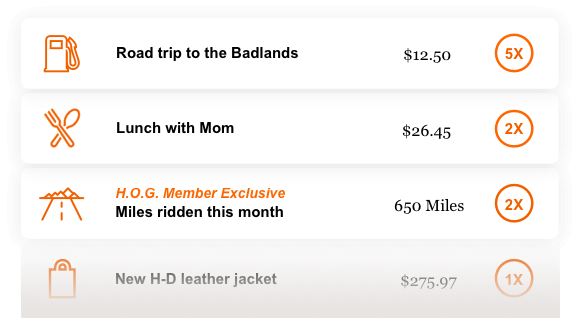

- H.O.G.® members earn 2 points for every mile ridden5

- $99 annual fee view Hog Elite Visa terms

-

5X

Earn 5X points at H‑D, gas and EV charging stations1

-

2X

Earn 2X points at restaurants, fast food, and bars1

-

2X

Earn 2X points at hotels & other lodging1

-

1X

Earn 1X points everywhere else Visa is accepted

H.O.G. Elite Visa Card

Grab the card that proves loyalty pays.

With a H.O.G. membership credit, annual dealership and SiriusXM credits, and the ability to earn up to 5x points on purchases, the H.O.G. Elite Visa card was made for serious H‑D riders. And when every 2,500 points gets you $25 at H‑D, you'll be racking up the rewards in no time. Get it all for just a $99 annual fee View Hog Elite Visa terms.

Apply Now for the H?D Hog Elite Visa Signature CardEverywhere H‑D

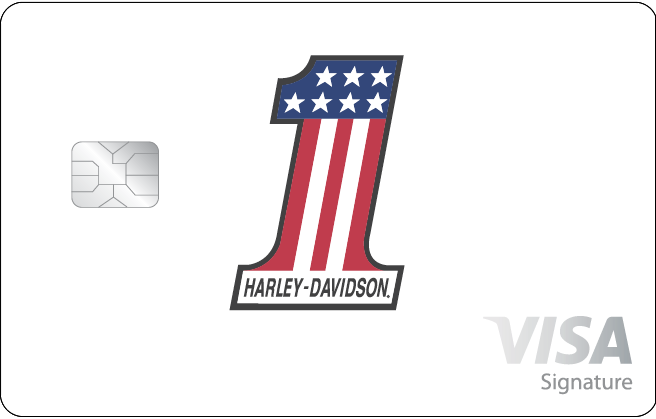

5X Points1at dealerships, h-d.com, the H‑D Museum, and Factory Tours

5X Points1

Gas and EV Charging Stations

5X Points1

Dining, Bars, Hotels & Other Lodging

2X Points1

Everywhere Else Visa is Accepted

1X Points1

H.O.G. Member Exclusive

Monthly Miles Ridden

2 Points for every mile ridden5

Free Ride Sweepstakes

See Official Rules (PDF)

1 Entry for every purchase4

H.O.G. members get 2 entries per purchase

Get up to $99 in annual statement credits3.

H.O.G. Membership Credit

Get $59 annually for your H.O.G. membership when you pay with your card. Lifetime H.O.G members: there's an exclusive bonus just for you6.

Dealership Credit

Get up to $30 annually for purchases made at dealerships.

SiriusXM Membership Credit

Get a $10 credit after your 11th consecutive monthly SiriusXM payment billed to your H.O.G. Elite Visa card.

Card benefits for every lifestyle.

Account Management

- Free credit score7

- Lock/unlock card

- Cardmember Support

Mobile App

- Redeem points for H‑D™ Gift Cards

- Check balances and review transactions

- Lock/unlock your card and enroll in security alerts

Peace of Mind

- Zero fraud liability8

- Roadside Dispatch9

- Lost/stolen card reporting

Travel Benefits9

- Travel Emergency Assistance

- Auto rental collision damage waiver

- Emergency cash and card replacement

- Shipt: Same-day delivery from a variety of stores you love

- Sofar: Discover new music with presale opportunities and ticket discounts

- Dovly: Fix, manage, and maintain your credit score

-

3X

Earn 3X points at H‑D, gas and EV charging stations1

-

2X

Earn 2X points at restaurants, fast food, and bars1

-

2X

Earn 2X points at hotels & other lodging1

-

1X

Earn 1X points everywhere else Visa is accepted

H-D™ Visa Signature® Card

Serious rewards for serious riders.

Get $100 at H‑D2

Just spend $500 on your H‑D Visa card in the first 90 days. Plus, get a 0% intro APR† on purchases and balance transfers* for 9 billing cycles. After that, a variable APR applies, currently 18.24% to 31.24% view H-D Visa Signature terms .

- No annual fee view H-D Visa Signature terms

- Purchases = entries into the Free Ride Sweepstakes4

See Official Rules (PDF). - H.O.G.® members earn 1 point for every mile ridden5

-

3X

Earn 3X points at H‑D, gas and EV charging stations1

-

2X

Earn 2X points at restaurants, fast food, and bars1

-

2X

Earn 2X points at hotels & other lodging1

-

1X

Earn 1X points everywhere else Visa is accepted

H‑D Visa Signature Card

For riders who want all the points and all the perks.

The more you use your card, the more points you'll earn, and every 2,500 points gets you $25 at H‑D.

Apply Now for the H?D Visa Signature CardEverywhere H‑D

3X Points1at dealerships, h‑d.com, the H‑D Museum, and Factory Tours

3X Points1

Gas and EV Charging Stations

3X Points1

Dining, Bars, Hotels & Other Lodging

2X Points1

Everywhere Else Visa is Accepted

1X Points1

H.O.G. Member Exclusive

Monthly Miles Ridden

1 Point for every mile ridden5

Free Ride Sweepstakes

See Official Rules (PDF)

1 Entry for every purchase4

H.O.G. members get 2 entries per purchase

Card benefits for every lifestyle.

Account Management

- Free credit score7

- Lock/unlock card

- Cardmember Support

Mobile App

- Redeem points for H‑D™ Gift Cards

- Check balances and review transactions

- Lock/unlock your card and enroll in security alerts

Peace of Mind

- Zero fraud liability8

- Roadside Dispatch9

- Lost/stolen card reporting

Travel Benefits9

- Travel Emergency Assistance

- Auto rental collision damage waiver

- Emergency cash and card replacement

- Shipt: Same-day delivery from a variety of stores you love

- Sofar: Discover new music with presale opportunities and ticket discounts

- Dovly: Fix, manage, and maintain your credit score

-

1X

Earn 1X points at H‑D, gas and EV charging stations

-

1X

Earn 1X points at dining, bars, hotels & other lodging

-

1X

Earn 1X points everywhere else Visa is accepted

H-D™ Visa® Secured Card

Earn rewards while building credit1,10.

- No annual fee view H-D scured Visa terms

- Build or repair credit10

- Earn points for purchases1

- Purchases = entries into the Free Ride Sweepstakes4

See Official Rules (PDF).

-

1X

Earn 1X points at H-D, gas and EV charging stations

-

1X

Earn 1X points at dining, bars, hotels & other lodging

-

1X

Earn 1X points everywhere else Visa is accepted

H‑D Visa® Secured Card

Take charge of your credit while you earn rewards.

Whether you're a first-time cardmember needing to build credit or a card-carrying veteran looking to rebuild your credit10, use the card that helps while also earning you points for Harley™ gear. Every 2,500 points earns you $25 at H‑D.

Apply NowEverywhere H‑D

1X Points1at dealerships, h‑d.com, the H‑D Museum, and Factory Tours

1X Points1

Gas and EV Charging Stations

1X Points1

Dining, Bars, Hotels & Other Lodging

1X Points1

Everywhere Else Visa is Accepted

1X Points1

Free Ride Sweepstakes

See Official Rules (PDF)

1 Entry for every purchase4

H.O.G. members get 2 entries per purchase

Is the Secured card right for you?

What is a secured card?

It's a credit card that offers you an opportunity to build or rebuild your credit with responsible use10. It requires a refundable security deposit, which is held as collateral for the account.

How much of a deposit is required?

You choose how much of a deposit you want to put down—from $300 - $5,000. The amount you choose then becomes the credit limit for your card. You can fund your deposit from a bank account, cashier's check, or money order.

Do I pay interest on purchases?

Yes, as with any credit card, there is an Annual Percentage Rate (APR) applied against purchases made with the card that are not paid off in full.

How do I get started?

When you apply for the card, you'll fill out the normal financial information plus the amount of security deposit you want to put on the card as well as select a funding method for the deposit.

Exclusive H‑D Visa card benefits

Account Benefits

Online Account Management

Free Access to Your Credit Score7

Card Protection

Zero Fraud Liability8

Lost/Stolen Card Reporting

Travel Benefits9

Auto Rental Collision Damage Waiver

Emergency Cash & Card Replacement

See how much you can earn.

Point multipliers represent H.O.G. Elite Visa card

H-D Visa exclusive perks.

Not only will you earn points for purchases, you'll get access to these unique benefits.

Earn points for every mile you ride

Harley Owners Group® members earn one point for every mile they ride5, but if you have the H.O.G. Elite Visa card, you can double that.

See Official Rules (PDF).

Enter the monthly Free Ride Sweepstakes

Every purchase you make with your card enters you into the H‑D™ Visa® Free Ride Sweepstakes for a chance to win a Harley‑Davidson® motorcycle every month4. And H.O.G. members get 2 entries per purchase.

Non-purchase, mail-in entry also available.

See Official Rules (PDF).

Everyday benefits for every cardmember.

Beyond earning points for awesome H-D® gear, you’ll get these sweet benefits no matter which H-D™ Visa card lives in your wallet.

Account Management

- Free credit score7

- Lock/unlock card

- Cardmember Support

Mobile App

- Redeem points for H-D™ Gift Cards

- Check balances and review transactions

- Lock/unlock card and enroll in security alerts

Travel Benefits9

- Travel Emergency Assistance

- Auto rental collision damage waiver

- Emergency cash and card replacement

- Shipt: Same-day delivery from a variety of stores you love

- Sofar: Discover new music with presale opportunities and ticket discounts

- Dovly: Fix, manage, and maintain your credit score

Peace of Mind

- Zero fraud liability8

- Roadside Dispatch9

- Lost/stolen card reporting

H-D™ Visa Cards FAQs

In most cases, when applying online, you will receive the status of your application immediately. If you are approved, your card will arrive in 7-10 business days.

If you are approved for the H‑D™ Visa® Secured card, you should receive your card 7–10 business days after we have received your application and initial security deposit.

As a H.O.G.™ Elite Visa Signature® cardmember, you will earn points based on eligible and net purchases (purchases are purchases minus credits and returns) made with your account. You will earn points as follows:

- 5 points for every $1 in eligible purchases during each billing cycle at merchants classified as H‑D® dealerships, h‑d.com, the H‑D Museum, gas stations and EV charging stations.

- 2 points for every $1 in eligible purchases during each billing cycle at merchants classified as restaurants, fast food, bars, hotels and other lodging.

- 1 point for all other eligible purchases during each billing cycle.

As a Harley‑Davidson® Visa Signature® cardmember, you will earn points based on eligible and net purchases (purchases are purchases minus credits and returns) made with your account. You will earn points as follows:

- 3 points for every $1 in eligible purchases during each billing cycle at merchants classified as H‑D® dealerships, h‑d.com, the H‑D Museum, gas stations and EV charging stations.

- 2 points for every $1 in eligible purchases during each billing cycle at merchants classified as restaurants, fast food, bars, hotels and other lodging.

- 1 point for all other eligible purchases during each billing cycle.

As a Harley‑Davidson® Secured Visa® cardmember, you will earn points based on eligible and net purchases (purchases are purchases minus credits and returns) made with your account. You will earn points as follows:

- 1 point for every $1 in eligible purchases during each billing cycle.

Please remember that U.S. Bank cannot control how merchants choose to classify their business or transactions and reserves the right to determine which purchases are eligible.

For complete program details, refer to the Program Rules located in the Rewards Center.